UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. ____)

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

|

| | | |

| | o | | Preliminary Proxy Statement |

| | | | |

| | o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | | | |

| | þ | | Definitive Proxy Statement |

| | | | |

| | o | | Definitive Additional Materials |

| | | | |

| | o | | Soliciting Material Pursuant to §240.14a-12 |

FIRST INTERSTATE BANCSYSTEM, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | | | |

| | þ | | No fee required. |

| | o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| | 5) | Total fee paid: |

| | o | | Fee paid previously with preliminary materials. |

| | o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| | 4) | Date Filed: |

March 15, 2019

To Our Shareholders,

If one word were to define our focus at First Interstate Bank, it would be: “relevancy.” In this digital and technological era, it is essential that relevancy remain front of mind as we define our purpose, consider our actions, and measure our results. From top to bottom and across all six states within our footprint, remaining relevant as a financial institution will be central to our strategy, to our efforts to serve our clients and communities, and ultimately to our success.

Looking back on 2018-and to the start of my tenure as President and CEO in 2015-remaining a relevant, growing company has been instrumental in pursuing First Interstate’s vision. Every day, we strive to be the premier financial services provider within the communities we serve. This means we are continuously focused on delivering products and processes that make our interactions more effective, efficient, and effortless. We believe that this will strengthen our relationships with our employees, our clients, and our communities, all while driving long-term shareholder value. We are accomplishing this by remaining laser-focused on three areas: our people, our processes, and our technology.

Our people are-and always will be-our most valuable asset. We take care of our employees and firmly believe that happy, engaged employees will pay dividends going forward. In 2018, we continued to invest in our people by enhancing our benefits, our training opportunities, and our communications at all levels to ensure our teams are aligned with our vision, mission, and values. We strengthened our executive team and instituted a senior leadership team. These two groups of leaders are diverse in gender, experience, and capabilities. They are a collaborative, cohesive team; the next generation of bankers poised to lead First Interstate forward.

Over the past year, we continued to enhance bank-wide systems and processes to ensure continued delivery of quality products and services to our clients while removing friction from the interaction. Through initiatives like our loan transformation process, we are streamlining workflows that will better serve our employees and our clients. We are nearing the culmination of our core transformation initiative, a comprehensive project that will allow us to better understand our clients in order to deliver the quality products and services they need. And we are upgrading our accounting and reporting systems, which will allow us to better measure and report on our progress.

We continued to invest in technology, implementing forward-looking solutions that will enable First Interstate to be on the leading-edge in adapting to-and adopting-inevitable changes in the industry. We are building an integration layer that will improve our capabilities to “plug and play” the platforms through which clients want to interact with us, now and well into the future. We are expanding our digital initiatives, delivering products and services to our clients in the manner in which they want to conduct business. From our highly-rated app to online mortgage, credit card, and small business applications to guided wealth management, we are investing in efficient delivery systems that meet our clients’ needs.

While investing in our people, processes and technology, we continue to consider strategic opportunities for growth through acquisitions. With the guiding principle that “bigger is not better, better is better,” we evaluate candidates based on their potential to enhance franchise value.

Last year we completed the acquisition of Inland Northwest Bank based in Spokane, Washington, and announced the pending acquisitions of northern Idaho-based Idaho Independent Bank and Community 1st Bank. Once these two acquisitions close, First Interstate will rank sixth in market share in Idaho, providing us with a position of strength in this market. All three banks are financially, strategically, geographically, and culturally compatible with First Interstate and our growth objectives.

In addition to contributing to our solid deposit base and strengthening our organic growth profile, all three of these community banks are committed to the people and places they serve. With our expanded footprint in northern Idaho and eastern Washington, we are excited to be able to elevate the ways we give back to these communities through financial and volunteer support.

While the financial industry may be ever-evolving, there are 12 guiding principles by which we lead this company that will withstand the test of time. They encompass the execution of our annual operating plans; financial goals, including earnings per share growth and return on equity metrics to be in the top tier of financial institutions; employee goals, relating to engaged leadership and employees; client goals, measuring loyalty and satisfaction; risk goals, including regulatory metrics, balance sheet management and risk management culture; and strategic goals, addressing our ability to remain relevant, focused on our community banking model, and effectively communicating to all of our stakeholders while remaining unwaveringly committed to our vision, mission, and values.

The future for banking is rife with uncertainty: the war for deposits, an uncertain interest rate environment, global trade wars, tariffs, the next industry disruptor, and changing consumer preferences. Because we cannot look to the environment to provide clarity, we must do so from within. Our 12 guiding principles-the framework in which we make decisions-will help forge a clear path toward increased future financial success.

Whatever the environment ahead, we are confident that we have built a solid foundation that will provide the flexibility needed to weather any storm. We manage with an eye toward risk, taking a conservative approach to deploying capital and being highly selective in acquisitions. Additionally, we are focused on growing not only our loan portfolio, but a solid base of deposits, which is critical to long-term success.

As we celebrate the 50th year of being a community bank, we believe we are putting the people, processes and technology to work that will allow us to remain a relevant, vibrant, profitable company committed to our people, our clients, our communities, and our shareholders for many years to come.

I am proud of the First Interstate team and its dedication and progress toward achieving our vision this past year. I look forward to leading it to greater successes in 2019.

Sincerely,

Kevin P. Riley

President and Chief Executive Officer

FIRST INTERSTATE BANCSYSTEM, INC.

401 North 31st Street

P.O. Box 30918

Billings, Montana 59116-0918

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

OF FIRST INTERSTATE BANCSYSTEM, INC.

To Be Held on Wednesday,Thursday, May 2, 20182019,

at 4:00 p.m., Mountain Daylight Time

NOTICE IS HEREBY GIVEN that the 20182019 Annual Meeting of Shareholders of First Interstate BancSystem, Inc. will be held at First Interstate Bank, Operations Center, 1800 Sixth Avenue North, Billings, Montana, on Wednesday,Thursday, May 2, 2018,2019, at 4:00 p.m., Mountain Daylight Time, for the following purposes:

| |

| 1. | To elect sixtwo directors to serve three-year terms, or until their respective successors have been elected and appointed; |

| |

| 2. | To ratify the appointment by the Board of Directors of two former Cascade Bancorp directors; |

| |

3. | To ratify the appointment of RSM US LLP as our independent registered public accounting firm for the year ending December 31, 2018;2019; |

| |

| 3. | To approve a charter amendment to provide for majority voting in the election of directors; |

| |

| 4. | To approve the adjournment of the annual meeting, if necessary or appropriate, to solicit additional proxies for the foregoing proposals; |

| |

| 5. | To adopt a non-binding advisory resolution on executive compensation; and |

| |

4.6. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Only shareholders of record as of the close of business on March 8, 20181, 2019 are entitled to notice of and to vote at the annual meeting and any adjournments or postponements thereof.

YOUR VOTE IS IMPORTANT TO US. Whether or not you plan to attend the annual meeting, we urge you to vote. Registered holders may vote:

By Internet - access http://www.voteproxy.com and follow the on-screen instructions;

By telephone - call 1-800-PROXIES (1-800-776-9437) in the United States or 1-718-921-8500 in foreign countries from any touch-tone telephone and follow the instructions;

By mail - sign, date and mail your proxy card in the envelope provided as soon as possible; or,

In person - vote your shares in person by attending the annual meeting.

|

| | |

| | BY ORDER OF THE BOARD OF DIRECTORS | |

|

| | |

| | Kirk D. Jensen | |

| | Corporate Secretary | |

Billings, Montana

March 16, 201815, 2019

|

|

20172018 EXECUTIVE SUMMARY |

| |

The following is a summary of certain keymaterial disclosures in our proxy statement. This is only a summary, and it may not contain all of the information that is important to you. For more complete information, please review the proxy statement in its entirety.

When we refer to the “Company,” “First Interstate,” “we,” “our,” and “us” in this proxy statement, we mean First Interstate BancSystem, Inc. and our consolidated subsidiaries, unless the context indicates that we refer only to the parent company, First Interstate BancSystem, Inc. When we refer to the “Bank” in this proxy statement, we mean First Interstate Bank, our bank subsidiary.

This proxy statement and accompanying proxy card are being provided on or about March 15, 2019 to our shareholders of record who are entitled to vote at the annual meeting.

| |

| Time and Date: | 4:00 p.m. Mountain Daylight Time, Wednesday,Thursday, May 2, 20182019 |

| |

| Place: | First Interstate Bank Operations Center |

1800 Sixth Avenue North

Billings, Montana 59101

| |

| Record Date: | Close of business on March 8, 20181, 2019 |

| |

| Voting: | Shareholders of record as of the record date are entitled to vote. Each outstanding share of Class A common stock is entitled to one vote and each outstanding share of Class B common stock is entitled to five votes on all matters submitted to a vote of shareholders. |

| |

| Attendance: | If you plan to attend the Annual Meetingannual meeting in person, you must bring the Notice of Internet Availability of Proxy Materials. If your shares are not registered in your name, you will need a legal proxy, account statement, or other documentation confirming your First Interstate BancSystem, Inc. holdings from the broker, bank, or other institution that holdsis the record holder of your shares. You will also need a valid, government-issued picture identification that matches your Notice of Internet Availability of Proxy Materials, legal proxy or other confirming documentation. |

| |

| Adjournments: | Any action on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed. |

|

| | | |

| Agenda and Voting Recommendations |

| Proposal | | Description | Board Recommendation |

| 1 | | Election of SixTwo Directors | "FOR"“FOR” each nominee

|

| | | | |

| 2 | | Ratification of Appointed DirectorsAppointment of Independent Registered Public Accounting Firm | "FOR"“FOR” |

| | | | |

| 3 | | RatificationApproval of AppointmentCharter Amendment to Provide for Majority Voting in the Election of Independent Registered Public Accounting FirmDirectors | "FOR"“FOR” |

| | | |

| 4 | | Approval of an Adjournment of the Annual Meeting, if Necessary or Appropriate, to Solicit Additional Votes for the Foregoing Proposals | “FOR” |

| | | |

| 5 | | Adoption of a Non-binding Advisory Resolution on Executive Compensation | “FOR” |

| | | |

REVIEW YOUR PROXY STATEMENT AND VOTE IN ONE OF FOURTHREE WAYS:

|

| | | | |

| : | VIA THE INTERNET | | * | BY MAIL |

| Visit the website listed on your proxy card | | Sign, date and return your proxy card in the enclosed envelope |

| | | | | |

) | BY TELEPHONE | | J | IN PERSON |

Call the telephone number on your proxy card | | |

| Attend the Annual Meeting in Billings, MT | | |

|

|

| Commitment to Good Corporate Governance |

We have structured our corporate governance program to promote the long-term interests of shareholders, strengthen the accountability of our Board of Directors ("Board"(“Board”) and management, and help build public trust in the Company. Highlights of our efforts include:

|

| |

| þ | Separation of the chair of the Board and chief executive officer roles; |

| þ | Appointment of a lead independent director;Lead Independent Director; |

| þ | Independent directors serve as chairs of our Audit, Governance & Nominating, Risk, Compensation, and CompensationTechnology Committees; |

| þ | Regular executive sessions of independent directors; |

| þ | Annual Board and committee self-evaluations; |

| þ | Stock ownership guidelines for directors and executive officers; and |

| þ | Cash and equity awards with clawback provisions. |

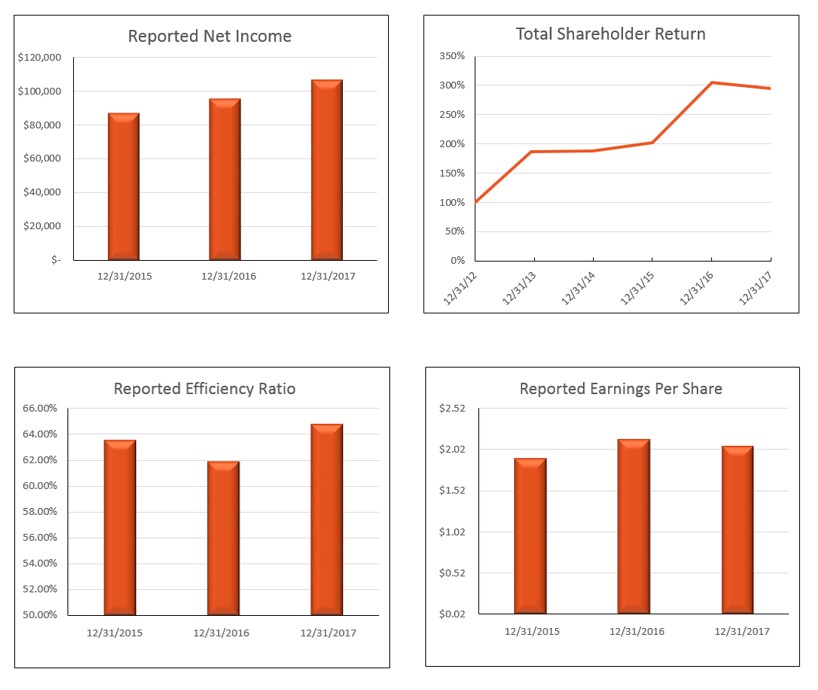

20172018 was a transformationalstrong year for First Interstate BancSystem, Inc. In January, we acquired the sole useBank. We had earnings per common share of the First Interstate name and brand from Wells Fargo & Company. This$2.75, which was a noteworthy accomplishment as34% increase over the prior year. Expansion in our net interest margin and the benefit of tax reform were the primary drivers behind our results. Building upon our initial entrance into the Northwest United States last year, in April, we preparedannounced the agreement to acquire Cascade Bancorp (“CACB”)Northwest Bancorporation, Inc., a bank holdingthe parent company that wholly-ownedof Inland Northwest Bank, of the Cascades, a $3.1 billion Oregon-basedan $826 million Washington-based community bank with 4620 banking offices across Washington, Idaho, Oregon, and Washington.Oregon. The acquisition closed in MayAugust and we successfully completed the conversionintegration in August. Our expansion into these dynamicNovember. In addition, in October, we signed definitive agreements to acquire two Idaho-based banks: Idaho Independent Bank, a $725 million community bank based in Coeur d’Alene, ID; and Community 1st Bank, a $130 million community bank based in Post Falls, ID. These three acquisitions complement our franchise and provide us with meaningful market share in attractive, high growth markets in the northwest added diversityEastern Washington and Northern Idaho. As a result of higher earnings, we were also able to increase our loan portfolio and enhanced growth opportunities for our franchise.quarterly dividend by 16.7%, to $0.28 per common share.

As we progressed through 2017,2018, we deliveredcontinued to focus on people, process, and technology as we sought to deliver to each of our stakeholders in meaningful and compelling ways …

For our employees … We believe our employees areAs our most valuable asset, we continued to strengthen our employee benefit package, provide greater training opportunities and we provide them with a compelling work environment and benefitsimprove Company-wide, interactive communications in order to support their financial and personal wellness.a healthy work environment.

For our clients … We continuecontinued to invest in systemsour digital platform and strengthen our business processes in order to operate more efficientlydeliver quality products and effectively, resulting in an improved operating efficiency ratioservices to our clients when and higher customer satisfaction ratings.where they choose to interact with us.

For our communities … We remain committed to our communities, including giving back 2% of our pre-tax earnings and encouraging | |

| • | For our communities … Commitment to our communities is at the core of our DNA and we continued to give back both financially and through employee volunteerism. In 2018 we celebrated our 50th anniversary with a Company-wide volunteer day to assist those less fortunate across our footprint. |

For our shareholders … We believe engaged employees, satisfied clients, and strong communities have consistentlya significant impact to our financial results, which ultimately allows us to meet the expectations of our shareholders. 2018 reported higher levels of return on average equity, average assets, and an expanded net income to shareholders for the last 30 years, and have paid over 23 years of consecutive quarterly dividends. We reportedinterest margin. Full year earnings of $106.5$160.2 million, or $2.05$2.75 per diluted share. During 2017, we increased quarterly dividendsshare, included merger related costs of $12.4 million, which impacted earnings per share by 9.1% to $0.24 per common share.$0.17.

|

|

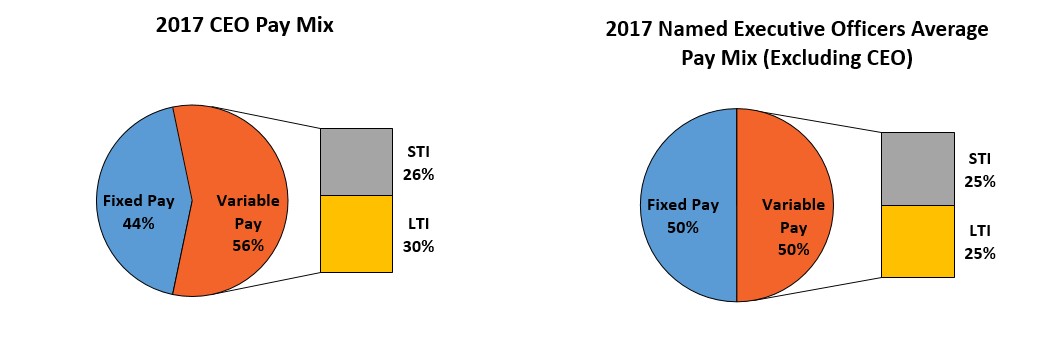

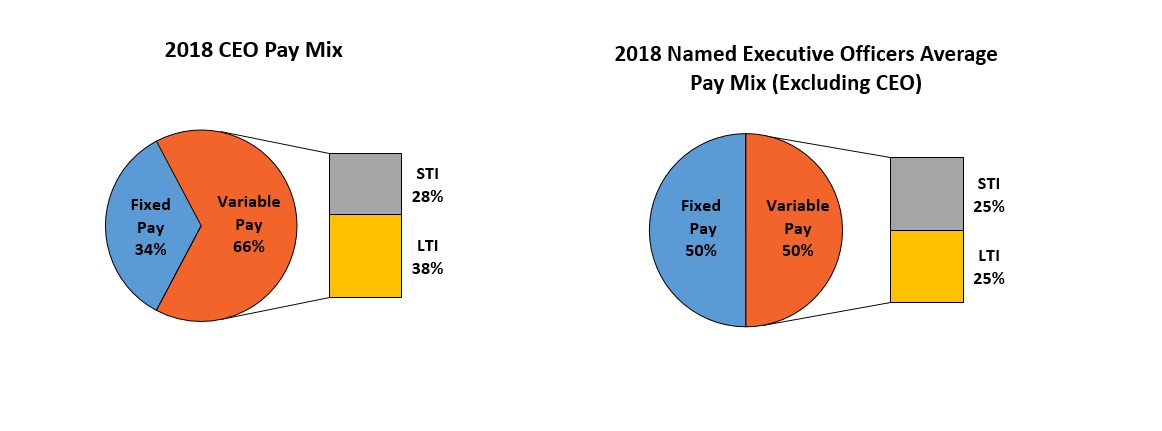

| Executive Compensation Highlights |

Our executive compensation program is aligned with our business strategy and is designed to maximize long-term shareholder value.

What We Pay and Why:Why; Goals and Elements of Compensation:

Emphasis on pay for performance;

Attract, retain, and motivate talented and experienced executives within the banking industry;

Recognize and reward executives whose skill and performance are critical to our success;

Align interests of our executives with our shareholders; and

Discourage inappropriate risk taking.

|

| | | |

| Key Features of our Executive Compensation Program: |

| | | | |

| What we do ... | What we don'tdo not do ... |

| þ | Emphasize pay for performance | ý | No short-selling or hedging of Company securities |

| þ | Use multiple performance measures and caps on potential incentive payments | ý | No single-trigger vesting of equity awards upon change in control |

| þ | Use independent compensation consultant | ý | No excessive perquisites |

| þ | Require minimum stock ownership for Directors and Executive Officers (EOs) | ý | No excise tax gross-ups |

| þ | Maintain a clawback policy to recapture incentive payments | ý | No repricing or recycling of shares |

| þ | Discourage risk taking by reserving the right to use discretion in the payout of all incentives | ý | No trading in Company securities during designated black-out periods, except under valid trading plans |

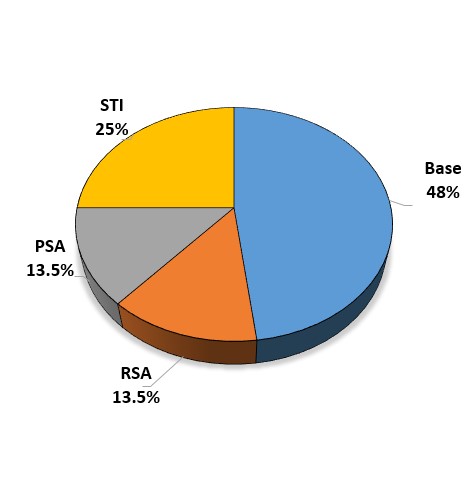

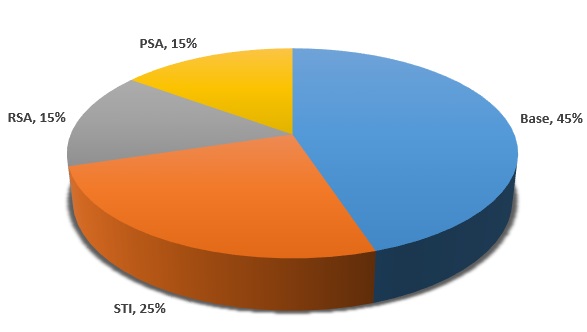

Elements of Total Compensation

Using a consistent and calibrated pay for performance approach across the Company, we reward results, discourage undue risk taking, and drive long-term shareholder value. To promote a culture that aligns the interests of management with those of our shareholders, our executive compensation program focuses on an appropriate mix of fixed and variable compensation.

We have three primary elements of compensation:

| |

| 1. | Base salary: Competitive fixed base cash compensation determined by individual factors, such as scope of responsibility, experience, and strategic impactimpact. |

| |

| 2. | Annual short-term cash incentive: Performance-based awards aligned with the achievement of individual and Company financial and strategic growth objectives andas determined by established thresholds. |

| |

| 3. | Long-term equity award incentive: Incentives to engage and retain executive officers, with an emphasis on long-term Company performance compared to peers. |

|

|

| PROPOSAL ONE - ELECTION OF DIRECTORS |

| |

At the end of fiscal year 2018, there were fifteen directors serving on the Board. The tenures of two directors who are not seeking re-election at the annual meeting, Jonathan R. Scott and William B. Ebzery, will end on May 2, 2019. A total of sixtwo directors, one of which is a current member of the Board, will be elected at the annual meeting to serve three-year terms, or until their respective successors have been elected and appointed. After the annual meeting, the Board will have fourteen directors divided into three groups with staggered three-year terms. The Board has nominated for election as directors:

David L. Jahnkedirectors at this annual meeting:

James R. Scott,

Kevin P. Riley

John M. Heyneman, Jr.

Ross E. LeckieRandall I. Scott

Teresa A. Taylor

AllJames R. Scott, Jr. is a current member of the director nominees areBoard. Randall I. Scott is not a current membersmember of the Board, with the exception of John M. Heyneman, Jr.

Board.

Unless authority to vote is withheld, the persons named in the enclosed proxy will vote the shares represented by such proxy for the election of the nominees named above. If, at the time of the annual meeting, any nominee becomes unavailable for any reason for election as a director, the persons entitled to vote the proxy will vote for the election of such substitute(s) as the Board may recommend. At this time, the Board knows of no reason why any nominee might be unavailable to serve.

The following tables set forth certain information regarding the nominees for election at the annual meeting and the directors continuing in office after the annual meeting.

|

| | | | |

| Name and Age | | Director Since | | Principal Occupation |

| | | | | |

James R. Scott, 68Jr., 41 | | 19712016 | | Chair of the Board,Commercial Loan Manager, First Interstate BancSystem, Inc.Bank, Medford |

Kevin P. Riley, 58 | | 2015 | | President and Chief Executive Officer, First Interstate BancSystem, Inc. |

David L. Jahnke, 64 | | 2011 | | Retired Partner, KPMG |

John M. Heyneman, Jr, 51Randall I. Scott, 65 | | N/A(1) | | Executive Director, Plank Stewardship Initiative |

Ross E. Leckie, 60 | | 2009 | | Retired Executive Vice President, Allianz SE |

Teresa A. Taylor, 54 | | 2012 | | Owner and Chief Executive Officer, Blue Valley Advisors, LLCManaging General Partner, Nbar5 Limited Partnership |

A majority of votes are needed to elect a director. This means that the six nominees for director must each respectively receive affirmative votes of 50% or more of the votes cast to be elected.

(1) Due to term limits that require certain Scott family members to have at least a one-year break in service after serving two consecutive three-year terms, John M. Heyneman, Jr.'sRandall I. Scott’s most recent term ended in May of 2016.2018. Mr. HeynemanScott first became a director of the Company in 1998.1993.

If a quorum is present at the annual meeting, a plurality of the shares entitled to vote and present in person or represented by proxy at the meeting are needed to elect a director. This means that the two nominees for director who receive the most affirmative votes for their election will be elected for a three year term.

The Board recommends a vote “FOR” each of the nominees named above.

|

|

Directors Continuing in Office After Annual Meeting(1) |

|

| | | | | | |

| Name and Age | | Director Since | | Term Expires | | Principal Occupation |

| | | | | | | |

| James R. Scott, Jr., 40 | | 2015 | | 2019 | | Commercial Loan Manager, First Interstate Bank, Medford |

| Jonathan R. Scott, 43 | | 2013 | | 2019 | | President, First Interstate Bank, Jackson |

| William B. Ebzery, 68 | | 2001 | | 2019 | | Owner, Cypress Capital Management, LLC, and Certified Public Accountant-retired |

| Charles E. Hart, M.D., 68 | | 2008 | | 2020 | | Retired President and Chief Executive Officer, Regional Health, Inc. |

| Dana L. Crandall, 53 | | 2014 | | 2020 | | Vice President-Service Delivery, Comcast |

| Dennis L. Johnson, 63 | | 2017 | | 2020 | | President and Chief Executive Officer, United Heritage Financial Group |

| Patricia L. Moss, 64 | | 2017 | | 2020 | | Retired President and Chief Executive Officer, Cascade Bancorp |

| Peter I. Wold, 70 | | 2016 | | 2020 | | President, Wold Energy Partners, LLC and CEO, Wold Oil Properties, LLC |

| Steven J. Corning, 65 | | 2008 | | 2020 | | President and Chief Executive Officer, Corning Companies |

|

| | | | | | |

| Name and Age | | Director Since | | Term Expires | | Principal Occupation |

| | | | | | | |

| James R. Scott, 69 | | 1971 | | 2021 | | Chair of the Board, First Interstate BancSystem, Inc. |

| Kevin P. Riley, 59 | | 2015 | | 2021 | | President and Chief Executive Officer, First Interstate BancSystem, Inc. |

| Steven J. Corning, 66 | | 2008 | | 2020 | | President and Chief Executive Officer, Corning Companies |

| Dana L. Crandall, 54 | | 2014 | | 2020 | | Vice President-Service Delivery, Comcast |

| Charles E. Hart, M.D., 69 | | 2008 | | 2020 | | Retired President and Chief Executive Officer, Regional Health, Inc. |

| John M. Heyneman, Jr., 52 | | 2018 | | 2021 | | Executive Director, Plank Stewardship Initiative |

| David J. Jahnke, 65 | | 2011 | | 2021 | | Retired Partner, KPMG |

| Dennis L. Johnson, 64 | | 2017 | | 2020 | | President and Chief Executive Officer, United Heritage Financial Group |

| Ross E. Leckie, 61 | | 2009 | | 2021 | | Retired Executive Vice President, Allianz SE |

| Patricia L. Moss, 65 | | 2017 | | 2020 | | Retired President and Chief Executive Officer, Cascade Bancorp |

| Teresa A. Taylor, 55 | | 2012 | | 2021 | | Owner and Chief Executive Officer, Blue Valley Advisors, LLC |

| Peter I. Wold, 71 | | 2016 | | 2020 | | President, Wold Energy Partners, LLC and CEO, Wold Oil Properties, LLC |

(1) Does not include James R. Scott, Jr. or Randall I. Scott, the two nominees for election to the Board at the annual meeting.

|

|

PROPOSAL TWO - RATIFICATION OF APPOINTED DIRECTORS |

|

In connection with the Company’s acquisition of CACB, the Company agreed to appoint two directors of CACB to the Company’s Board. On May 25, 2017, the Board appointed Dennis L. Johnson and Patricia L. Moss, former directors of CACB, as directors of the Company effective on the date the acquisition closed, May 30, 2017. The Board appointed Mr. Johnson and Ms. Moss each to three-year terms to expire in 2020, subject to shareholder approval and ratification.

The following table sets forth certain information regarding the directors whose appointment is subject to shareholder ratification at the annual meeting.

|

| | | | | | |

| Name and Age | | Director Since | | Term Expires | | Principal Occupation |

| | | | | | | |

| Dennis L. Johnson, 63 | | 2017 | | 2020 | | President and Chief Executive Officer, United Heritage Financial Group |

| Patricia L. Moss, 64 | | 2017 | | 2020 | | Retired President and Chief Executive Officer, CACB |

A majority of votes are needed to ratify the appointment of a director. This means that the two directors whose appointment is subject to ratification must each respectively receive affirmative votes of 50% or more of the votes cast to have their appointment ratified.

The Board recommends a vote “FOR” ratifying the appointment of each of the directors named above.

|

|

PROPOSAL THREE - RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| |

RSM US LLP was appointed by the Audit Committee of the Board as our independent registered public accounting firm for the year ending December 31, 2018.2019. While the Audit Committee is directly responsible for the appointment, compensation, retention, and oversight of our independent registered public accounting firm, the Audit Committee has requested that the Board of Directors submit the selection of RSM US LLP to our shareholders for ratification as a matter of good corporate governance. No representatives of RSM US LLP are expected to be present at the annual meeting.

Neither the Audit Committee nor the Board of Directors is required to take any action as a result of the outcome of the vote on this proposal. However, if our shareholders do not ratify the selection of RSM US LLP as the selected independent registered public accounting firm, the Audit Committee will consider whether to retain RSM US LLP or to select another independent registered public accounting firm. Furthermore, even if the selection is ratified, the Audit Committee in its discretion may appoint a different independent registered public accounting firm at any time during the year if it determines that such a change is in the best interest of the Company and our shareholders.

Proxies solicited hereby will be voted for the proposal unless a vote against the proposal or abstention is specifically indicated. AIf a quorum is present at the annual meeting, the affirmative vote of a majority of the voting power of the shares entitled to vote and present in person or represented by proxy at the annual meeting are needed to ratify the appointment of the independent registered public accounting firm. This means that the appointment of RSM US LLP as the independent registered public accounting firm for the Company will be ratified if more than 50% of the votes present in person or by proxy and entitled to vote at the annual meeting are cast by shareholders in favor of ratification exceed those votes cast in opposition of ratification.

The Board recommends a vote “FOR” ratifying the appointment of RSM US LLP as

our independent registered public accounting firm.

|

|

| PROPOSAL THREE - APPROVAL OF CHARTER AMENDMENT TO PROVIDE FOR MAJORITY VOTING IN THE ELECTION OF DIRECTORS |

|

Under the Montana Business Corporation Act, unless otherwise provided in the articles of incorporation, directors are elected by a plurality of the votes cast by the shares entitled to vote in the election at a meeting at which a quorum is present. The Board, based upon the recommendation of its Governance & Nominating Committee and other factors, has determined it to be in the best interests of the Company and its shareholders to memorialize in the Company’s articles of incorporation the adoption of a majority voting standard in the election of directors to complement the Company’s existing corporate governance policies and to further the Company’s efforts in enhancing its corporate governance practices. In furtherance of the foregoing, the Board has approved for shareholder consideration at this meeting an amendment to Section 5 of Article VI of the Company’s Second Amended and Restated Articles of Incorporation, which amendment would include a new second sentence thereto that would read in its entirety as follows:

Directors shall be elected by a majority of the voting power of the shares of capital stock present in person or represented by proxy at an annual meeting of shareholders and entitled to vote on the election of directors.

The Board believes that the proposed amendment will encourage active shareholder participation in the election of directors and enhance the Company’s existing corporate governance policies and practices. It is possible, however, that the proposed amendment could have the effect of making the election of a director more difficult in a contested election. The proposed change to a more rigorous majority voting standard is not, however, being proposed for the purpose of making a contested director election more difficult or in response to any known efforts by any person to propose a director nominee for election to the Board.

If the amendment is approved by the shareholders, the amendment will become effective upon the filing of the appropriate amendment documentation with the Montana Secretary of State. The Company intends to make any such authorized filing promptly following the annual meeting, and in any event such that the majority voting standard as so adopted in the Company’s articles of incorporation would be applicable to the election of directors at the 2020 annual meeting of shareholders.

Proxies solicited hereby will be voted for the proposal unless a vote against the proposal or abstention or non-vote is specifically indicated. If a quorum is present at the meeting, this proposal will be approved if the votes cast at the meeting by the shareholders, favoring the proposal exceed the votes cast by shareholders opposing the proposal. This means that the amendment to the charter will be approved if more than 50% of the votes present in person or by proxy that are cast by shareholders at the annual meeting, without regard to abstentions or non-votes, are cast “for” this proposal.

The Board recommends a vote “FOR” approval of the charter amendment to provide for majority voting in the election of directors.

|

|

| PROPOSAL FOUR - APPROVAL OF THE ADJOURNMENT OF THE ANNUAL MEETING, IF NECESSARY OR APPROPRIATE, TO SOLICIT ADDITIONAL PROXIES FOR THE FOREGOING PROPOSALS |

|

We are asking our shareholders to vote on a proposal to approve the adjournment of the annual meeting, if necessary or appropriate, to solicit additional proxies for the foregoing proposals.

As discussed above, our Board recommends a vote FOR the election of each of the Director nominees, FOR the ratification of RSM US LLP as the Company’s independent registered public accounting firm, and FOR the Charter amendment to provide for majority voting in the election of directors. If there are insufficient proxies at the time of the annual meeting to approve any of the foregoing proposals the Company shareholders may be asked to vote on this proposal to adjourn this annual meeting to a later date to allow additional time to solicit additional proxies. The Board does not currently intend to propose adjournment at the annual meeting if there are sufficient votes to approve the foregoing matters.

Proxies solicited hereby will be voted for the proposal unless a vote against the proposal or abstention or non-vote is specifically indicated. If a quorum is present at the meeting, this proposal will be approved by the shareholders if a majority of the voting power of the shares present in person or by proxy and entitled to vote on the matter cast their votes in favor of the adjournment. This means that the adjournment will be approved if more than 50% of the votes present in person or by proxy at the annual meeting and entitled to vote are cast by shareholders “for” this proposal.

The Board recommends that you vote “FOR” the approval to adjourn the annual meeting, if necessary or appropriate, to solicit additional proxies for the foregoing proposals.

|

|

| PROPOSAL FIVE - ADOPTION OF NON-BINDING ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION |

|

Section 14A of the Exchange Act provides shareholders an opportunity to cast a non-binding advisory vote to approve the compensation of the “named executive officers” identified in the Summary Compensation Table included on page 37 of this document.

The Company’s general compensation philosophy is that executive compensation should align with shareholders’ interests without encouraging excessive or unnecessary risk. First Interstate executive compensation programs, which are described in greater detail in the Compensation Discussion and Analysis portion of this document beginning on page 27, are designed to attract and retain qualified executive officers and establish an appropriate relationship between executive pay and First Interstate’s annual financial performance and long-term growth objectives. Long-term executive compensation, through awards of restricted First Interstate Class A common stock containing time- and performance-based vesting provisions, encourages growth in executive stock ownership and helps drive performance that rewards both executives and shareholders.

The advisory vote on this resolution is not intended to address any specific element of executive compensation; rather, the advisory vote relates to the compensation of the Company’s named executive officers as disclosed in this document in accordance with the Securities and Exchange Commission’s (“SEC’s”) compensation disclosure rules. The vote is advisory only, which means that it is not binding on the Company, its Board, or the Compensation Committee of the Board. The Company’s Board and its Compensation Committee value the opinions of shareholders and therefore will take into account the outcome of the vote when considering future executive compensation arrangements.

Accordingly, the shareholders are requested to vote on the following resolution at the Company’s annual meeting of shareholders:

RESOLVED, that the First Interstate shareholders approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in this document pursuant to the compensation disclosure rules of the SEC, including the Compensation Discussion and Analysis portion of this document, the Summary Compensation Table included in this document, and the other related tables and disclosures included in this document.

Proxies solicited hereby will be voted for the proposal unless a vote against the proposal or abstention or non-vote is specifically indicated. If a quorum is present at the annual meeting, we will consider the non-binding, advisory approval of the compensation paid to our named executive officers to have occurred if the vote of a majority of the voting power of the shares present or represented by proxy at the meeting and entitled to vote on this matter is voted for the resolution. This means that the approval will be obtained if more than 50% of the votes present in person or by proxy at the annual meeting are cast by shareholders “for” this proposal.

The Board recommends a vote “FOR” the approval of the compensation of the named executive officers as disclosed in this document.

|

|

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

| |

The following table sets forth information regarding the beneficial ownership of our common stock as of March 8, 20181, 2019 for (i) each of our directors and director nominees, (ii) each of the executive officers named in the summary compensation table, (iii) all directors and executive officers as a group, and (iv) beneficial owners of more than 5% of a class of our common stock.

We have determined beneficial ownership in accordance with the rules of the Securities and Exchange Commission ("SEC").SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the persons and entities named in the table below have sole voting and investment power with respect to all shares of common stock that they beneficially own, subject to applicable community property laws.

Percentage of class beneficially owned as of March 8, 20181, 2019 is based on 34,065,64538,281,996 shares of Class A common stock and 22,641,50922,394,860 shares of Class B common stock outstanding. In computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, we deemed shares of each class of common stock subject to options held by that person that were exercisable on or within 60 days of March 8, 20181, 2019 to be outstanding. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person. In computing the number of shares of Class A common stock beneficially owned by a person and the percentage of Class A common stock ownership of that person, we assumed the conversion of any Class B common stock beneficially owned by such person into Class A common stock on a share-for-share basis. We did not deem these shares converted, however, for the purpose of computing the percentage ownership of any other person.

Certain of our directors, a director nominee, and greater than 5% shareholders, who own collectively and in the aggregate more thanapproximately 30% of our outstanding common stock and over 50% of ourthe voting power of outstanding common stock, are members of a "group,"“group,” as that term is defined in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"“Exchange Act”). This group is composed of the following individuals and two entities controlled by James R. Scott and Randall I. Scott: James R. Scott, Randall I. Scott, Thomas W. Scott, John M. Heyneman, Jr., Susan S. Heyneman, and Homer A. Scott, Jr.

Unless otherwise noted below, the address for each director, director nominee, named executive officer and beneficial owner of more than 5% of a class of our common stock listed in the table below is: c/o First Interstate BancSystem, Inc., 401 North 31st Street, Billings, Montana 59101.

(The remainder of this page intentionally left blank)

| | BENEFICIAL OWNERSHIP TABLE | | | | Class A Common Stock | | Class B Common Stock | | Class A Common Stock | | Class B Common Stock |

| | | Beneficially Owned | | Beneficially Owned | | Beneficially Owned | | Beneficially Owned |

| Name of Beneficial Owner | | Number | | Percent | | Number | | Percent | | Number | | Percent | | Number | | Percent |

| | | |

| Directors and nominees for director | Directors and nominees for director | | Directors and nominees for director | |

Randall I. Scott(1) | | 5,431,999 | | 13.8% | | 5,409,135 | | 23.9% | |

James R. Scott(2) | | 4,956,670 | | 12.7 | | 4,890,957 | | 21.6 | |

James R. Scott(1) | | | 4,932,217 | | 11.4% | | 4,862,707 | | 21.7% |

Randall I. Scott(2) | | | 4,755,839 | | 11.1 | | 4,738,975 | | 21.2 |

John M. Heyneman, Jr.(3) | | 1,675,933 | | 4.7 | | 1,669,893 | | 7.4 | | 1,674,505 | | 4.2 | | 1,669,893 | | 7.5 |

Jonathan R. Scott(4) | | 792,673 | | 2.3 | | 763,895 | | 3.4 | |

William B. Ebzery(5) | | 168,178 | | * | | 4,464 | | * | |

Jonathan R. Scott(4)(#) | | | 755,336 | | 1.9 | | 741,973 | | 3.3 |

William B. Ebzery(5)(#) | | | 144,750 | | * | | — | | * |

| Kevin Riley | | 93,711 | | * | | — | | * | | 104,894 | | * | | — | | * |

Ross E. Leckie(6) | | 23,659 | | * | | — | | * | |

Charles E. Hart, M.D.(7) | | 28,680 | | * | | 4,464 | | * | |

Steven J. Corning(8) | | 25,390 | | * | | 15,208 | | * | |

Charles E. Hart, M.D.(6) | | | 29,252 | | * | | — | | * |

Steven J. Corning(7) | | | 25,962 | | * | | 15,208 | | * |

| Ross E. Leckie | | | 19,231 | | * | | — | | * |

| James R. Scott, Jr. | | | 18,358 | | * | | — | | * |

| David L. Jahnke | | 10,513 | | * | | — | | * | | 11,085 | | * | | — | | * |

Theodore H. Williams# | | 11,570 | | * | | — | | * | |

| James R. Scott, Jr. | | 17,312 | | * | | — | | * | |

Patricia L. Moss(8) | | | 8,405 | | * | | — | | * |

| Peter I. Wold | | | 8,372 | | * | | 6,884 | | * |

| Teresa A. Taylor | | 6,055 | | * | | — | | * | | 6,627 | | * | | — | | * |

| Dana L. Crandall | | 4,100 | | * | | — | | * | | 5,245 | | * | | — | | * |

| Patricia L. Moss | | 8,182 | | * | | — | | * | |

| Dennis L. Johnson | | 1,872 | | * | | — | | * | | 2,444 | | * | | — | | * |

| Peter I. Wold | | 7,800 | | * | | 6,884 | | * | |

| | | |

| Named executive officers who are not directors | | |

Marcy D. Mutch(9) | | 22,046 | | * | | — | | * | | 30,001 | | * | | — | | * |

| William D. Gottwals | | 23,320 | | * | | — | | * | | 26,018 | | * | | — | | * |

| Kirk D. Jensen | | | 14,491 | | * | | — | | * |

| Jodi Delahunt Hubbell | | | 14,052 | | * | | — | | * |

Philip G. Gaglia(10) | | | 12,168 | | * | | — | | * |

| Stephen W. Yose | | 11,617 | | * | | — | | * | | 8,420 | | * | | — | | * |

| Kirk D. Jensen | | 11,091 | | * | | — | | * | |

| | | |

| All executive officers and directors as a group (24 persons) | | 11,710,582 | | 25.9 | | 11,101,209 | | 49.0 | |

| All executive officers and directors as a group (21 persons) | | | 7,827,573 | | 17.2 | | 7,296,665 | | 32.6 |

| | | |

| 5% or greater security holders | | |

First Interstate Bank(10) | | 7,382,863 | | 18.2 | | 6,556,173 | | 29.0 | |

Dimensional Fund Advisors LP(11) | | 2,379,533 | | 7.1 | | — | | * | |

| 6300 Bee Cave Rd, Building One | | |

| Austin, TX 78746 | | |

Vanguard Group, Inc.(12) | | 2,286,441 | | 6.8 | | — | | * | |

Scott Family Control Group(11) | | | 16,298,982 | | 29.9 | | 16,165,841 | | 72.2 |

First Interstate Bank(12) | | | 4,575,794 | | 10.9 | | 3,813,320 | | 17.0 |

| N Bar 5 Limited Partnership | | | 3,795,676 | | 9.0 | | 3,795,676 | | 16.9 |

Vanguard Group, Inc.(13) | | | 3,167,921 | | 8.3 | | — | | * |

| 100 Vanguard Blvd. | | |

| Malvern, PA 19355 | | |

Bank of New York Mellon Corp(13) | | 2,382,440 | | 7.1 | | — | | * | |

| 225 Liberty Street | | |

| New York, NY 10286 | | |

| Homer A. Scott, Jr. | | 2,313,889 | | 6.4 | | 2,281,496 | | 10.1 | |

Thomas W. Scott(14) | | 2,274,038 | | 6.3 | | 2,273,538 | | 10.0 | |

Macquarie Group, Limited(15) | | 1,852,197 | | 5.6 | | — | | * | |

Macquarie Group, Limited(14) | | | 2,719,902 | | 7.1 | | — | | * |

| 50 Martin Place | | |

| Sydney, NSW 2000 C3 2000 | | |

BlackRock, Inc.(15) | | | 2,472,238 | | 6.5 | | — | | * |

| 55 East 52nd Street | | |

| New York, NY 10055 | | |

Thomas W. Scott(16) | | | 2,253,038 | | 5.6 | | 2,251,938 | | 10.1 |

| Homer A. Scott, Jr. | | | 2,250,673 | | 5.6 | | 2,221,703 | | 9.9 |

| J.S. Investments | | | 2,127,036 | | 5.3 | | 2,127,036 | | 9.5 |

| | | |

* Less than 1% of the class of common stock outstanding. | # Mr. Williams' tenure as a director will end on March 22, 2018. | |

# The tenures of Jonathan R. Scott and William B. Ebzery will end on May 2, 2019. | | # The tenures of Jonathan R. Scott and William B. Ebzery will end on May 2, 2019. |

| |

(1)

| Includes 3,795,676 Class B shares owned beneficially as managing general partner of Nbar5 Limited Partnership, 357,840 Class B shares owned beneficially as general partner of Nbar5 A Limited Partnership, 670,160 Class B shares owned beneficially as acting managing general partner for various Scott family partnerships, 429,180 Class B shares owned beneficially as co-trustee for Scott family members, and 9,648 Class A shares owned through our profit sharing plan. |

| |

(2)(1)

| Includes 2,127,036 Class B shares owned beneficially as managing partner of J.S. Investments Limited Partnership, 35,240 Class B shares owned beneficially as president of the James R. and Christine M. Scott Family Foundation, 75,85273,002 Class B shares owned beneficially as conservator for a Scott family member, 7,096 Class B shares owned beneficially as trustee for a Scott family member, 322,641 Class B shares and 36,38937,663 Class A shares owned beneficially as a board member of Foundation for Community Vitality, a non-profit organization, and 17,764 Class A shares owned through our profit sharing plan. |

| |

(2) | Includes 3,795,676 Class B shares owned beneficially as managing general partner of Nbar5 Limited Partnership, 357,840 Class B shares owned beneficially as general partner of Nbar5 A Limited Partnership, 429,180 Class B shares owned beneficially as co-trustee for Scott family members, and 9,648 Class A shares owned through our profit sharing plan. |

| |

(3) | Includes 1,085,792 Class B shares owned beneficially as managing general partner of Towanda Investments, Limited Partnership, and 429,180 Class B shares owned beneficially as co-trustee for Scott family members. |

| |

(4) | Includes 158,392162,352 Class B shares owned beneficially as trustee for Scott family members, 4,916 Class B shares issuable under stock options and 9,995 Class A shares issuable under stock options.members. |

| |

(5) | Includes 29,00031,000 Class A shares owned through a family limited partnership, and 13,0812,214 Class A shares issuable under stock options. |

| |

(6) | Includes 1,6324,186 Class A shares issuable under stock options. |

| |

(7) | Includes 4,1861,960 Class B shares issuable under stock options and 1,972 Class A shares issuable under stock options. |

| |

(8) | Includes 4,464 Class B shares issuable under stock options and 1,972380 Class A shares issuable under stock options.owned through our profit sharing plan. |

| |

(9) | Includes 164 Class A shares owned through our profit sharing plan. |

| |

(10) | Includes 774,2301,079 Class A shares owned through our profit sharing plan. |

| |

(11) | The Scott Family Control Group includes Randall I. Scott, N Bar 5 Limited Partnership, James R. Scott, J.S. Investments Limited Partnership, John M. Heyneman, Jr., Thomas W. Scott, Homer A. Scott, Jr. and Susan S. Heyneman. The group beneficially owns an aggregate of 16,298,982 shares, representing 53.9 percent of the voting power of the outstanding common stock. |

| |

(12) | Includes 686,063 Class A shares that may be deemed to be beneficially owned as trustee of our profit sharing plan, 30,06676,411 Class A shares that may be deemed to be beneficially owned as trustee for Scott family members and 6,556,1733,813,320 Class B shares that may be deemed to be beneficially owned as trustee for Scott family members. Shares owned beneficially by First Interstate Bank, as trustee, may also be beneficially owned by participants in our profit sharing plan and certain Scott family members. |

| |

(11)(13)

| Based solely on a Schedule 13G/A13G filed with the SEC on February 9, 2018 and prepared as of December 31, 2017. Dimensional Fund Advisors LP, an investment advisor, serves as investment manager or sub-adviser to certain other commingled funds, group trusts and separate accounts (collectively referred to as the “Funds”). In certain cases, subsidiaries of Dimensional Fund Advisors LP may act as an adviser or sub-adviser to certain Funds. In its role as investment advisor, sub-adviser and/or manager, Dimensional Fund Advisors LP or its subsidiaries (collectively, “Dimensional”) may possess voting and/or investment power over our Class A shares owned by the Funds, and may be deemed to be the beneficial owner of the Class A shares held by the Funds. The Funds have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of the Class A shares held in their respective accounts. To the knowledge of Dimensional, the interest of any one such Fund does not exceed 5% of our Class A shares. |

| |

(12)

| Based solely on a Schedule 13G/A filed with the SEC on February 7, 2018.11, 2019. Includes: (1) 24,99529,070 shares of First Interstate common stock held by Vanguard Fiduciary Trust Company a wholly-owned subsidiary of the Vanguard Group Inc. As a result of its serving as an investment manager of collective trust accounts; and (2) 3,4195,160 shares of First Interstate common stock by Vanguard Investments LTD., a wholly-owned subsidiary of the Vanguard Group, Inc. as a result of its serving as an investment manager of Australian investment offerings. |

| |

(13)

| Based solely on a Schedule 13G filed with the SEC on February 7, 2018. The Bank of New York Mellon Corporation reports sole voting power over 2,177,207 shares and sole and shared dispositive power over 2,091,535 shares and 287,141 shares, respectively. Each of BNY Mellon IHC, LLC and MBC Investments Corporation reports sole voting power over 1,971,008 shares and sole and shared dispositive power over 1,885,329 shares and 287,141 shares, respectively. All of the securities are reported as beneficially owned by The Bank of New York Mellon Corporation and its direct or indirect subsidiaries in their various fiduciary capacities. |

| |

(14) | Includes 222,528 Class B shares owned beneficially as owner of IXL Ranch, LLC. |

| |

(15)

| Based solely on a Schedule 13G filed with the SEC on February 14, 2018.2019. Macquarie Group Limited and Macquarie Bank Limited both report beneficial ownership over these shares because of their ownership in the following two entities but no voting or dispositive power over such shares, and Macquarie Investment Management Holdings Inc. and Macquarie Investment Management Business Trust both report sole voting and dispositive power over 1,846,5722,710,093 of such shares. |

| |

(15) | Based solely on a Schedule 13G filed with the SEC on February 8, 2019. BlackRock, Inc. reports sole voting power over 2,395,386 shares and sole dispositive power over 2,472,238 shares. All of the securities are reported as beneficially owned by BlackRock, Inc. and its direct or indirect subsidiaries in their various fiduciary capacities. |

| |

(16) | Includes 222,528 Class B shares owned beneficially as managing member of IXL Ranch, LLC. |

|

|

| Directors and Executive Officers |

| |

The following table sets forth information concerning each of our directors, who will be continuing as such after the annual meeting, director nominees and executive officers.

|

| | | | |

| Name | | Age | | Position |

| | | | | |

| James R. Scott | | 6869 | | ChairChairman of the Board |

David L. JahnkeKevin P. Riley | | 6459 | | President, Chief Executive Officer and Director |

| Steven J. Corning | | 6566 | | Director |

| Dana L. Crandall | | 53 | | Director |

William B. Ebzery | | 6854 | | Director |

| Philip G. Gaglia | | 5455 | | Executive Vice President and Chief Risk Officer |

Kevin J. Guenthner(1)

| | 54 | | Senior Vice President and Chief Information Officer |

| Charles E. Hart, M.D. | | 6869 | | Director |

| John M. Heyneman, Jr. | | 5152 | | Director Nominee |

Jodi D.Delahunt Hubbell | | 5253 | | Executive Vice President and Chief Operating Officer |

| David L. Jahnke | | 65 | | Director |

| Kirk D. Jensen | | 4748 | | Executive Vice President and General Counsel |

| Dennis L. Johnson | | 6364 | | Director |

| Ross E. Leckie | | 6061 | | Director |

| Patricia L. Moss | | 6465 | | Director |

| Marcy D. Mutch | | 5859 | | Executive Vice President and Chief Financial Officer |

| Renee L. Newman | | 4849 | | Executive Vice President and Chief Banking Officer |

Kevin P. RileyKade G. Peterson | | 5853 | | Executive Vice President and Chief ExecutiveInformation Officer and Director |

Randall I. Scott | | 64 | | Director |

Jonathan R. Scott | | 43 | | Director |

| James R. Scott, Jr. | | 4041 | | Director |

| Randall I. Scott | | 65 | | Director Nominee |

| Teresa A. Taylor | | 5455 | | Director |

| Peter I. Wold | | 7071 | | Director |

(1) Mr. Guenthner announced his resignation, effective March 23, 2018.

|

James R. Scott has been a director of ours since 1971, the chairChairman of the Board since January 2016, the executive vice chairExecutive Vice Chairman of the Board from 2012 to January 2016, and the vice chairVice Chairman of the Board from 1990 to 2012. Mr. Scott has served as a director of First Interstate Bank since 2007, serving as chairChairman since 2011. Mr. Scott is managing partner of J.S. Investments, vice presidentVice President of the Foundation for Community Vitality, board member of First Interstate BancSystem Foundation, and lifetime trustee at Fountain Valley School of Colorado. Mr. Scott also served as chairChairman of the Padlock Ranch Corporation from 1999 to 2017, chair of1999-2017, Homer A. and Mildred S. Scott Foundation from 1990 to 2006, and chairChairman of Scott Family Services, Inc. from 2003 to 2012. Mr. Scott is the father of James R. Scott, Jr., and the uncle of Jonathan R. Scott, John M. Heyneman, Jr., Jonathan R. Scott and Randall I. Scott.

The qualifications of Mr. Scott identified by the Board include the following: Mr. Scott has significant executive management, business and corporate governance experience as a result of his years of service to the Company and other family-related businesses. Mr. Scott has extensive knowledge of key issues, dynamics and trends affecting the Company, its business, and the banking industry in general. He also has extensive knowledge of the Company’s unique challenges, regulatory environment, and history. Mr. Scott serves as chairChairman of the executive committee.Executive Committee and serves on the Compensation Committee, Nominating & Governance Committee, and the Technology Committee.

|

|

David L. JahnkeKevin P. Riley |

David L. JahnkeKevin P. Riley has been a directorPresident and Chief Executive Officer of ours since September 2011. In 2010, Mr. Jahnke completedFirst Interstate Bank and a 35-year career as a partner of KPMG with a focus on global clients, especially in the financial services industry. He currently serves as a director and chairman of the audit committee to Swiss Re America Holding Corporation and its primary related US operating companies. Mr. Jahnke also serves as a director, chair of the audit committee, and member of the compensation committeeBoard of Directors since September 2015. Prior to Schnitzer Steel Industries, Inc.,his current role, Mr. Riley served as an Executive Vice President and the Chief Financial Officer from 2013 to 2015. Mr. Riley leads First Interstate Bank with expertise drawn from more than 32 years of experience in the banking industry. Prior to joining the organization, he was an Executive Vice President and Chief Financial Officer for Berkshire Hills Bancorp in Massachusetts, and he served in various executive-level positions with KeyCorp. Mr. Riley earned a NASDAQ-listed company.

Bachelor of Science in business administration from Northeastern University in Boston, Massachusetts.

The qualifications of Mr. JahnkeRiley identified by the Board include the following: Mr. Jahnke has significant experience in the accounting, auditing and financial service industries, both nationally and internationally. Mr. JahnkeRiley has extensive knowledge in theof key issues, dynamics and trends affecting the Company, its business, and the banking industry in general. He has extensive knowledge regarding fiduciary obligations, insuranceMr. Riley also provides strategic insight and other legal requirements and duties of a public company.direction to the Company. Mr. Jahnke qualifies as an independent director, is a financial expert,Riley serves as chair ofon the audit committee, and is a member of the risk committee. Mr. Jahnke also serves as lead independent director.Executive Committee.

Steven J. Corning has been a director of ours since 2008. Mr. Corning has served as presidentPresident and chief executive officerChief Executive Officer of Corning Companies, a real estate development firm, and has also been the presidentPresident and broker/owner of Corning Companies Commercial Real Estate Services since 1979. Mr. Corning received his Bachelor of Arts degree in American Government, Cum Laude, from Harvard University.

The qualifications of Mr. Corning identified by the Board include the following: Mr. Corning has significant executive management, business ownership and entrepreneurial experience as a result of his years in the real estate development industry, which gives him a unique perspective as to real estate and property trends. Mr. Corning has extensive knowledge in key issues, dynamics and trends that affect the Company, including real estate, real estate development, asset management, investment consulting, and the health care industry. Mr. Corning qualifies as an independent director and serves as chair ofon the credit committee.Compensation and Risk Committees.

Dana L. Crandall has been a director of ours since 2014. Ms. Crandall has over 25 years of experience in executive management and global operations. She has been vice presidentVice President - service deliveryService Delivery of Comcast, a public company with more than 120,000 employees, since December 2013. Prior to that, Ms. Crandall was a managing directorManaging Director and chief information officerChief Information Officer of British Telecom from 2009 to 2013, Vice President - Network Strategy and Call Center Operations at Qwest Communications from 2005 to 2009, and served in various other executive-level positions with Qwest Communications from 1992 to 2005. Ms. Crandall received her Bachelor of Science degree in Electrical Engineering from the University of Denver in 1987 and her Master in Business Administration degree from Northwestern University - Kellogg School of Management in 2001.

The qualifications of Ms. Crandall identified by the Board include the following: Ms. Crandall has significant knowledge in strategic planning, technology development, and operations management. She also has knowledge on the fiduciary obligations, governance, operations practices, and other requirements and duties of a public company. Ms. Crandall qualifies as an independent director and serves as chairChairman of the technology committee.

William B. Ebzery has been a director of ours since 2001. Mr. Ebzery is a certified public accountant (retired)Technology Committee and registered investment advisor. Mr. Ebzery has been the owner of Cypress Capital Management, LLC since 2004. Prior to Cypress Capital Management, LLC, Mr. Ebzery was a partner in the certified public accounting firm of Pradere, Ebzery, Mohatt & Rinaldo from 1975 to 2004. Mr. Ebzery received his Bachelor of Science degree in Accounting from the University of Wyoming.

The qualifications of Mr. Ebzery identified by the Board include the following: Mr. Ebzery has significant experience in business ownership, accounting, auditing and financial services as a resultmember of his years in the private sector. Mr. Ebzery has significant knowledge of key issues, dynamics and trends that affect the Company. Mr. Ebzery qualifies as an independent director.Audit Committee.

Philip G. Gaglia has been an executive vice presidentExecutive Vice President of First Interstate since 2018, a Senior Vice President from 2009 to 2018, and chief risk officerChief Risk Officer of First Interstate since 2012. Prior to his current position, Mr. Gaglia served as senior vice president since 2009, vice presidentVice President and general auditorGeneral Auditor of First Interstate Bank from 2003 to 2010, and in various internal audit positionsfrom 1991 to 2003, and various operations roles from 1989 to 2003.1991. Mr. Gaglia has a Bachelor of Science degree in Business with a Management option from Montana State University - Billings in Billings, Montana and is a graduate of the Pacific Coast Banking School.

Kevin J. Guenthner has been our senior vice president and chief information officer since March 2003. In addition, Mr. Guenthner has served on the board of First Interstate Bank since March 2012. Prior to his current position, Mr. Guenthner served as our vice president and general auditor from September 1996 to March 2003, and in various internal audit positions from January 1991 to September 1996. Prior to employment with us, Mr. Guenthner was employed as a bank examiner for the State of Montana from January 1989 to January 1991. Mr. Guenthner has a Bachelor of Science degree in Business with an Accounting option from Montana State University and is an honors graduate of the Pacific Coast Banking School.

Charles E. Hart, M.D., M.S. has been a director of ours since 2008. Dr. Hart serves on the 340B Health Board as well as the South Dakota Community Foundation Board where he is Chairman of the Audit Committee and a member of the Investment Committee. Previously, Dr. Hart served as presidentPresident and chief executive officerChief Executive Officer of Regional Health, Inc., a not-for-profit healthcare system serving western South Dakota and eastern Wyoming from 2003 to 2015. Dr. Hart served as a director, board vice-chairmanBoard Vice-Chairman and chairmanChairman of the governance committee of the board of directors of Premier Inc., a healthcare purchasing organization listed on the NASDAQ exchange, and past chairmanChairman of the boardBoard and board member of Safety Net Hospitals for Pharmaceutical Access. Dr. Hart received his Bachelor of Science degree in Pre-professional Studies from the University of Notre Dame, his Doctor of Medicine degree from the University of Minnesota, and his Masters of Science in Administrative & Preventative Medicine from the University of Wisconsin.

The qualifications of Dr. Hart identified by the Board include the following: In addition to his understanding of community needs in the practice of medicine, Dr. Hart has significant experience in executive management and business as a result of years of administrative service in the healthcare industry as well as service on other community boards. Dr. Hart has extensive knowledge in key issues, dynamics, and trends that affect the Company and understands the economies of our region and communities the Company serves. Dr. Hart brings geographic diversity to the Board. Dr. Hart qualifies as an independent director and serves as chairChairman of the governanceNominating & nominations committee.Governance Committee. Dr. Hart is also a member of the Compensation Committee.

John M. Heyneman, Jr. has been a director of ours since May 2018 and was previously a director of ours from 1998 to 2004 and from 2010 to 2016. Mr. Heyneman is based in Sheridan, Wyoming as the executive directorExecutive Director for the Plank Stewardship Initiative, a nonprofit organization providing technical solutions to ranchers in the Northern Great Plains. Additionally, Mr. Heyneman is Chairman of the Padlock Ranch, a diversified cow-calf, farm, and feedlot operation based in Dayton, Wyoming. Mr. Heyneman contracted with the North Main Association, a private non-profit organization focused on economic development and business recruitment in Sheridan, Wyoming from February of 2013 to December of 2015. From November 2009 to November 2012, Mr. Heyneman served as the Wyoming project managerProject Manager for Sonoran Institute, a non-profit organization based in Tucson, Arizona. From 2005 to November 2009, Mr. Heyneman served as the general managerGeneral Manager of North Rim Ranch, LLC, a large cattle ranch in northern Arizona and southern Utah. Prior to this position, from 1998 to 2005, Mr. Heyneman served as an assistant managerAssistant Manager at Padlock Ranch, in Dayton, Wyoming. Mr. Heyneman received a Master of Science Degree from Montana State University, Bozeman, and a Bachelor of Arts degree in American Studies from Carleton College. Mr. Heyneman is an N.A.C.D Leadership Fellow. Mr. Heyneman is the nephew of James R. Scott and the cousin of Jonathan R. Scott, James R. Scott, Jr., and Randall I. Scott. Mr. Heyneman was recommended for Board service by the Scott family council.

Family Council.

The qualifications of Mr. Heyneman identified by the Board include the following: Mr. Heyneman brings to the Board executive management and business experience from the agriculture industry. Mr. Heyneman understands the economies of the region and communities the Company serves. Mr. Heyneman also possesses knowledge of the Company’s unique challenges, regulatory environment and history as a result of his years of service to the Company. Mr. Heyneman is a member of the Compensation Committee and the Nominating & Governance Committee.

Jodi Delahunt Hubbell has been the Company’s Chief Operating Officer since 2018 and Executive Vice President and Chief Banking Officer - West from 2017 to 2018. Ms. Delahunt Hubbell has over 30 years of diverse banking experience, including executive leadership roles in retail, small business, commercial, finance, and risk management. Prior to her employment with the Company, Ms. Delahunt Hubbell was Executive Vice President and Director, Risk Management at Zions Bancorporation in Salt Lake City. Beginning her banking career in 1987 as a management trainee in Portland, Oregon, the vast majority of her extensive experience has been in the western U.S., with banks such as The Commerce Bank of Oregon, Zions Bancorporation, U.S. Bancorp, and Centennial Bank. Ms. Delahunt Hubbell earned a bachelor’s degree in Business Administration from the University of Portland, received a Human Resource Management Certificate from Villanova University, and completed Wharton’s RMA Advanced Risk Management program in 2016.

David L. Jahnke has been a director of ours since September 2011. In 2010, Mr. Jahnke completed a 35-year career as a partner of KPMG with a focus on global clients, especially in the financial services industry. He currently serves as a Director and Chairman of the audit committee to Swiss Re America Holding Corporation and its primary related US operating companies. Mr. Jahnke also serves as a Director, Chairman of the audit committee and member of the compensation committee to Schnitzer Steel Industries, Inc., a NASDAQ-listed company. The qualifications of Mr. Jahnke identified by the Board include the following: Mr. Jahnke has significant experience in the accounting, auditing, and financial service industries, both nationally and internationally. Mr. Jahnke has extensive knowledge in the key issues, dynamics and trends affecting the Company, its business, and the banking industry in general. He has extensive knowledge regarding fiduciary obligations, insurance, and other legal requirements and duties of a public company. Mr. Jahnke qualifies as an independent director, financial expert, and a risk expert. Mr. Jahnke serves as Chairman of the Audit Committee and is a member of the Risk Committee and Executive Committee.

Kirk D. Jensen has been executive vice presidentExecutive Vice President and general counselGeneral Counsel of First Interstate since January 2017, and senior vice presidentSenior Vice President and general counselGeneral Counsel from 2016 to 2017. Prior to his employment with First Interstate, Mr. Jensen was a partner with the law firm BuckleySandler LLP in Washington, D.C., from 2009 to 2015, and practiced law with firms in Washington, D.C. since 2001. Mr. Jensen clerked for the Honorable Deanell Reece Tacha, Chief Judge of the United States Court of Appeals for the Tenth Circuit, from 2000 to 2001. He earned his Juris Doctor degree from Duke University School of Law in Durham, North Carolina, and his Bachelor of Arts degree in Classical Studies from Brigham Young University in Provo, Utah.

Dennis L. Johnsonhas been a director of ours since May 2017. Mr. Johnson has been presidentPresident and chief executive officerChief Executive Officer of United Heritage Mutual Holding Company since 2001, and United Heritage Financial Group and United Heritage Life Insurance Company, which are insurance, annuity, and financial products companies, since 1999. Mr. Johnson served as presidentPresident and chief executive officerChief Executive Officer of United Heritage Financial Services, a broker-dealer, from 1994 to 1998 and served as general counselGeneral Counsel of United Heritage Mutual Holding Company and certain of its affiliates from 1983 to 1999. Mr. Johnson is a former trustee of the Public Employees Retirement System of Idaho and currently serves on the Idaho State Treasurer’s Investment Advisory Board.Citizens’ Committee on Legislative Compensation appointed by the Idaho Supreme Court. Mr. Johnson also sits on the Board of Directors of IDACORP, Inc. and Idaho Power Company.

The qualifications of Mr. Johnson by the Board include the following: Mr. Johnson has financial, risk management, and legal experience acquired through his extensive work experience at insurance companies and as general counsel of United Heritage. Mr. Johnson also has knowledge of economics and finance and experience with employee benefits and auditing matters. Mr. Johnson’s long-standing ties to our footprint also provide an important connection to our service area and allow him to offer insight into local, state, and regional issues where we conduct business. Mr. Johnson qualifies as an independent director, a financial expert, is an independent director,a risk expert, and is a member of the credit committeeAudit Committee and audit committee.Risk Committee.

Ross E. Leckie has been a director of ours since May 2009. In October 2008, Mr. Leckie completed a 27-year career as a partner with KPMG. During that time, his focus was on public companies ofand financial services clients. Commencing in 2000, Mr. Leckie was based in Frankfurt, Germany, ultimately serving as KPMG's global lead partnerKPMG’s Global Lead Partner for a global investment/universal bank and as a senior technicalSenior Technical and quality review partnerQuality Review Partner for a global investment/universal bank based in Zurich, Switzerland. After retiring from KPMG, Mr. Leckie continued to provide advisory services on a selective basis for global and domestic financial services companies including Allianz, a global financial services group based in Munich, Germany. In 2011, he joined Allianz in Munich full time, taking on consultative and quality assurance roles in the office of the Chief Financial Officer. After returning to the U.S. in late 2013, he has continued to serve Allianz in Munich on a part-time basis.basis through 2016. Additionally, in 2012 and 2013, Mr. Leckie served as Deputy-Chair of the boardBoard and audit committee chairAudit Committee Chair of Allianz Bank Bulgaria.

The qualifications of Mr. Leckie identified by the Board include the following: Mr. Leckie has significant experience in the accounting, auditing, and financial services industries, both nationally and internationally. Mr. Leckie has extensive knowledge in the key issues, dynamics, and trends affecting the Company, its business and the banking industry in general. Mr. Leckie has extensive knowledge regarding fiduciary obligations and other legal requirements and duties of a public company. Mr. Leckie qualifies as a financial expert, a risk expert, is an independent director, serves as chairChairman of the risk committee,Risk Committee, and is a member of the credit committee, executive committee, and audit committee.Audit Committee.

Patricia L. Moss has been a director of ours since May 2017. Ms. Moss served as chief executive officerChief Executive Officer of Bank of the Cascades and presidentPresident and chief executive officerChief Executive Officer of Cascade from 1998 to 2012. She currently serves as a directorDirector of MDU Resources, Inc., the Oregon Growth BoardInvestment Council and funds within the Aquila Tax Free TrustGroup of Oregon.Funds. Ms. Moss is a former board member of Clear One Health Plans, the Oregon Growth Board, and has served on various community boards, including Central Oregon Community College, Oregon State University Cascades Campus, and St. Charles Medical Center. Ms. Moss also serves as chairman of the Bank of the Cascades Foundation.

The qualifications of Ms. Moss by the Board include the following: Ms. Moss has business experience and knowledge of the Pacific Northwest economy and state, local, and region issues. Ms. Moss has experience in finance and banking, as well as experience in business development through her work at Cascade Bancorp and Bank of the Cascades, and on the Oregon Investment Fund Advisory Council, the Oregon Business Council, and the Oregon Growth Board. Ms. Moss also has experience as a certified senior professional in human resources. Ms. Moss qualifies as an independent director and serves on the compensation committee,Compensation Committee, the governanceGovernance & nominating committee,Nominating Committee, and the executive committee.Executive Committee.